Recent searches

Search options

Now the fun begins. I’ll be up most of the night trading this shit, so I’ll share some thoughts here while data comes in.

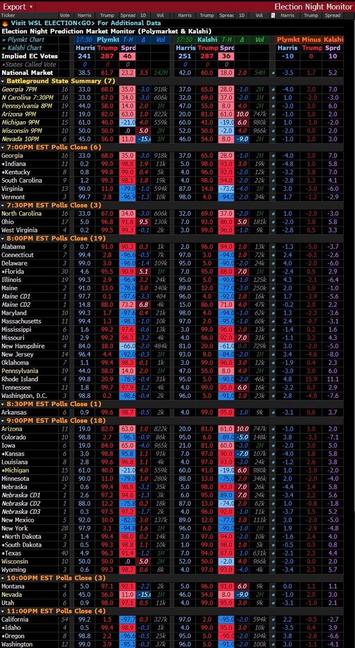

Bloomberg terminal has some great data aggregation stuff too, “WSL ELECNIGHT <GO>” if you’re on a terminal, which I’ll try to share here quickly. So far exit polling is uninteresting and no real results have been revealed.

I doubt we know who wins tonight unless it’s a real blowout, but it will be fun regardless.

Markets starting to move a bit.

Bonds bid (rates off), S&P, RTY, and BTC bid. EUR and MXN get sold.

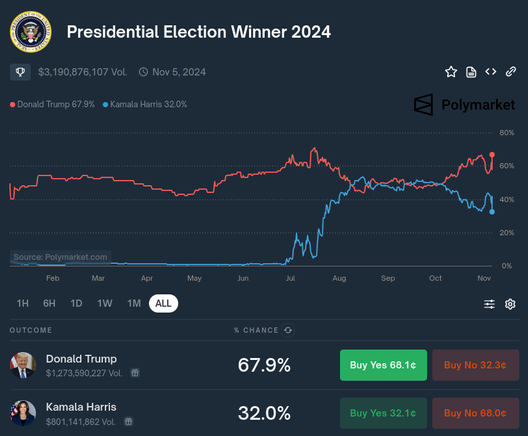

Trump odds rising in betting markets: Trump 68% vs Harris at 32%. Still VERY early, but notice the market reaction now.

S&P futures still ramping, bitcoin rising (correlated to betting market odds). Still very early though, and much of the betting market moves are likely due to trading flow punting in larger than usual size (thin books right now).

Still low count numbers in a hand full of swing states (except Ohio). NC at less than 10% reporting, PA just 5%, Michigan just 2%. Ohio though has 35% reporting with Harris in a pretty clear lead so far, 52% vs Trump at 47%.

Exit polls from Georgia show independent voters voting 54% for Trump and 43% for Harris, which is likely why the market for Trump skyrocketed temporarily. Still early.

VA and OH now reporting nearly 50% of votes with Trump in the lead. Shows how this race is far from over, and many more flips are likely to happen.

GA seems to be in Trump territory, leading almost 5% with 60% reporting

I still think that PA will be the bellwether, very low reporting so far and if that flips Trump it could be over

Markets have stalled though drastically, equities hanging near intraday highs, bonds as well. BTC still outperforming, but it has far more beta compared to equities

No real updates from the states, bit of a push ahead from Trump. Trump still needs PA, MI, or WI to secure a win in my opinion.

But, the market is ripping again which reflects the sentiment that Trump is leading. NYC's needle predictor is also favoring Trump, which makes me nervous but the data supports him pushing ahead right now.

Bitcoin absolutely ramping and outpacing all other risk-on assets which correlate to a Trump victory. Up 6% right now vs 3% on small cap index RTY.

Trump odds on betting markets now cresting 80%, but again this is far from over. The swing states have not yet been called, and I think Trump still needs PA, MI, or WI to really secure this thing.

Markets however are trading as if Trump already has it locked in, but I'm not convinced yet.

By 6% I mean 8% now... Traders getting liquidated I'm sure, this move is insane. RTY will similarly just ramp all day tomorrow if Trump locks it in.

Can't believe it, but I just bought some Kamala to win the presidential election for 12%. So roughly an 8:1 payout. I don't think she wins, but it's an emotional/trading hedge which has gotten crazy cheap.

Trump leads in PA by a good margin, almost 3 points now. He's also leading in GA by 3 points. NC as well, leading nearly by 7 points. Looking for both MI and WI Trump wins, and if that happens then I think he's got it.

To be clear: the race is looking like it's over for Kamala, this 12% bet is purely a hedge because 8:1 to bet some overnight flips will happen seems quite cheap in terms of a hedge

@nbs Trump currently under-performing in what has been reported from Bucks County, PA according to Rich Barris.

Of course, still early.

Yeah his PA performance and Ohio performances are not looking great. Surprising to see betting markets still holding high for him (think this is a sell for now).

Really want to see how PA, OH, NC, and Wisconsin go before it's over.

What is your take on Polymarket as a predictor?

Trading firms use it as an input for election model pricing, but it is a relatively small market. Tonight it's unreliable as a predictor just because it's so trading-based, but it's a good proxy to see how Trump/Kamala are doing in terms of sentiment for the reported states' votes.

I'm watching it as one of my signals

The only thing to be cautious of is large flow (trades) pushing these %s out of reality. Think this happened a couple of weeks ago when I posted about Kamala being at 33.3% and too cheap.

While $4b is a lot of money, in markets that is very very small. So $100mm of a bet one way or the other can push this market around pretty easily.

Bigger markets just have bigger whales.

No not really. Equity indices and fixed income markets are too large for even the Fed to move in a significant way

Take today's bond auction for example. The Treasury is the entire supply of the auction, but the bond market is trillions of dollars (not including derivatives) in size. So even a sale of $200b in Treasury notes won't move the market significantly

Same goes for the S&P or other indices. The market is still too large for any one participant to move it in the long run

I could find another 10k randoms on Twitter who've been following the advice of ZeroHedge (and losing money) who aren't professionals and lack info

Financial markets are great for selling content, it's easy to make click-bait claims without any expertise but cherry-picked data given how many variables are at play

I can say that not one person in my firm follows/knows this guy, lol. Global trading firm, about 20-24% market share on major indices. Not bragging, just proving credibility

Well, that's useful. I generally can't pick apart one person from another. I know the dumb gold bugs and end-of-the-dollar-ists aren't worth paying attention to, but someone who does a good job of sounding smart.

Twitter is unfortunately full of nonsense on the financial side. I used to be active there, have an account with 10k followers, but back in like 2022 it became more or less a shit show. I don't post anymore.

Coworkers of mine who are legit traders and smart dudes also have left, since "FinTwit" became pretty much click-bait subscription sellers.

I'll recommend a few good follows in the next reply

Twitter handles worth following:

-TheFlowHorse (crypto, former prop trader I'm friends with)

-hkuppy (hedge fund guy, biased but smart)

-kevinmuir (Co-host of Market Huddle podcast)

-SqueezeMetrics (options/derivatives focused)

-Callum_Thomas (fixed income bank trader)

-JimmyJude13 (former floor trader, friend of mine)

-vixologist (great volatility trader, good info)

-therobotjames (shitposts a lot now, but great former quantitative bank trader, also a friend)

Continued

-bennpeifert (liberal douche but a great former Barclays volatility trader, now runs a fund but doesn't post anymore)

-HF_trader (former CLO/CDO trader who made it back in 2008)

-SinclairEuan (probably the best volatility trader to follow, doesn't post much anymore)

-Paxtrader777 (pure scalping, short term futures trader, former floor guy, also a good friend of mine)

-pat_hennessy (works at a fund out west, good dude)

-volmagorov (former Citadel oil trader friend of mine)

Continued

-686Prism (Greek dude, close friend of mine, absolute genius options/rates trader, self-made)

-TheSpeculator0 (comes off as a douche, former market maker, knows what he's talking about though)

-lebas_janney (fundamental fixed income guy, good market color)

-BlacklionCTA (Texas hedge fund guy, energy market wiz, friend of mine)

-AgustinLebron3 (good education material, former bank trader)

-Husslin_ (friend of mine, former bank guy, GREAT trader running his own fund now)

Continued

-MacroTactical (self-made futures trader, one of the best I know, good friend of mine)

-ALBACapMgmt (Aussie, former Tudor Investments guy, great vol trader)

-PauloMacro (sales guy, but great market info/understanding)

-macrocephalopod (quant English trader, former bank guy, friend of mine)

-moreproteinbars (former Susquehanna market maker, now oil fund manager, one of the best options traders I know, good friend of mine)

-EffMktHype (Bond fund manager, fixed income guru)

Continued

-Citrini7 (probably the best thematic stock investor I know, great friend of mine I met on Twitter, hang out with him often, has been on Bloomberg, etc)

-Dcpcooks (another former bond pit trader, very good with fixed income/bond markets, also a friend)

-donnelly_brent (writes good books about trading, good follow for education)

-conksresearch (THE BEST by a long shot fixed income/bond researcher/trader I know. pretty in depth write ups, but WELL worth it if you want to know about the Fed)

There are a few others I haven't mentioned, just scrolled my following list for like half of it, but all of those I mentioned her also follow really genuine/good traders. Highly recommend all of them.

About 80% of them I've now met in person and sometimes work with, all great traders and I've learned a ton from them even after becoming a career trader.